HIGHLIGHTS

Applicability Dates

The PCORI fee applies to plan or policy years ending after Sept. 30, 2012, and before Oct. 1, 2029.

Payment Deadline

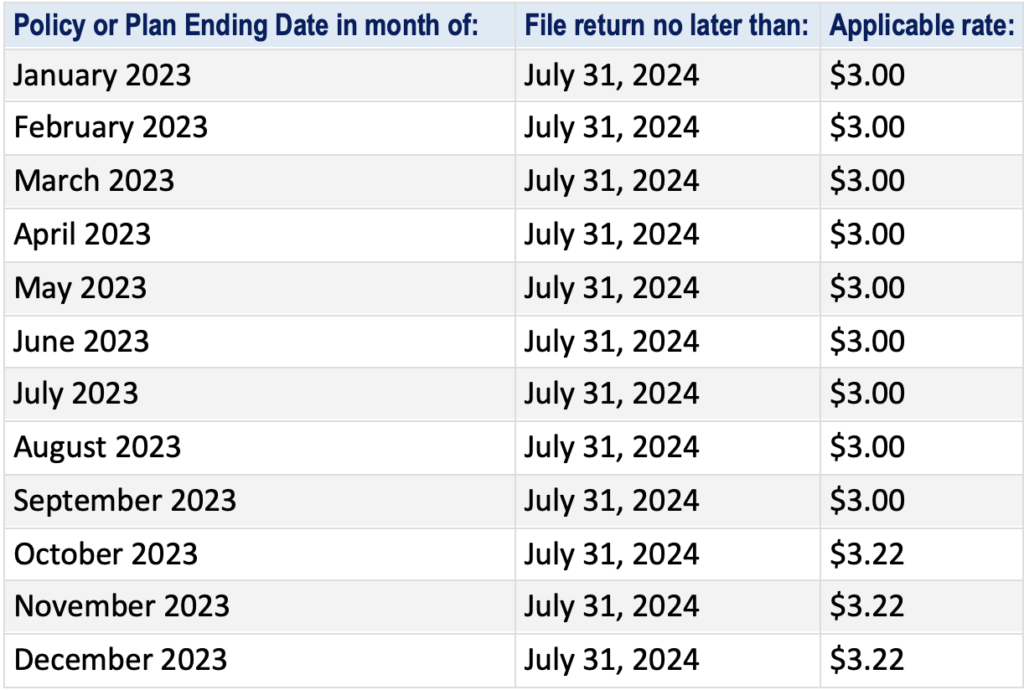

Issuers and plan sponsors must report and pay the PCORI fees annually using IRS Form 720. PCORI fees are due for plan or policy years ending in 2023 on July 31, 2024.

Issuers and plan sponsors that file Form 720 only to report the PCORI fee, do not need to file Form 720 for the first, third or fourth quarter of the year.

The Affordable Care Act (ACA) requires health insurance issuers and self-insured plan sponsors to pay Patient-Centered Outcomes Research Institute fees (PCORI fees). The fees are reported and paid annually using the IRS Form 720, the Quarterly Federal Excise Tax Return.

Form 720 and full payment of the PCORI fees are due by July 31 of each year, and generally covers plan years that end during the preceding calendar year. Please note that IRS Form 720, which is the form used by self-funded plan sponsors to file and pay the PCORI fee annually, has not yet been published for Q2 2024 reporting.

Form 720 and full payment of the PCORI fees are due by July 31 of each year, and generally covers plan years that end during the preceding calendar year. For plan years ending in 2023, the PCORI fees are due by July 31, 2024.

Overview of PCORI Fees

The PCORI fees were scheduled to expire for plan years ending on or after Oct. 1, 2019. However, a federal spending bill enacted at the end of 2019 extended the PCORI fees for an additional 10 years. As a result, these fees will continue to apply for the 2020-2029 fiscal years.

Calculating the PCORI Fee

In general, the PCORI fees are assessed, collected and enforced like taxes. The PCORI fee is imposed on an issuer of a “specified health insurance policy” and a plan sponsor of an “applicable self-insured health plan” based on the average number of lives covered under the plan. Final rules outline a number of alternatives for issuers and plan sponsors to determine the average number of covered lives.

No action is required for employers sponsoring a fully insured group health plan since the PCORI fee is already included in their monthly premium payments by their health insurance carriers UNLESS the employer provides a Health Reimbursement Account (HRA). In this case, the fee must be paid for each employee enrolled in the HRA.

Using Part II, Number 133 of Form 720, issuers and plan sponsors report the average number of lives covered under the plan separately for specified health insurance policies and applicable self-insured health plans. That number is then multiplied by the applicable rate for that tax year ($3.00 for plan years ending on or after Oct. 1, 2022, and before Oct. 1, 2023, or $3.22 for plan years ending on or after Oct. 1, 2023, and before Oct. 1, 2024). The fees for specified health insurance policies and applicable self-insured health plans are then combined to equal the total tax owed.

Action Steps

To assess their obligations, employers should:

- • Determine which plans are subject to the PCORI fees;

- • Assess plan funding status (insured versus self-insured) to determine whether the issuer or the employer is responsible for the fees; and

- • For self-insured plans, select an approach for calculating average covered lives.

The IRS provides helpful resources, including a chart on how the fees apply to specific types of health coverage or arrangements.

Download the Sharable Compliance Update below!

Check out our other blog articles HERE.