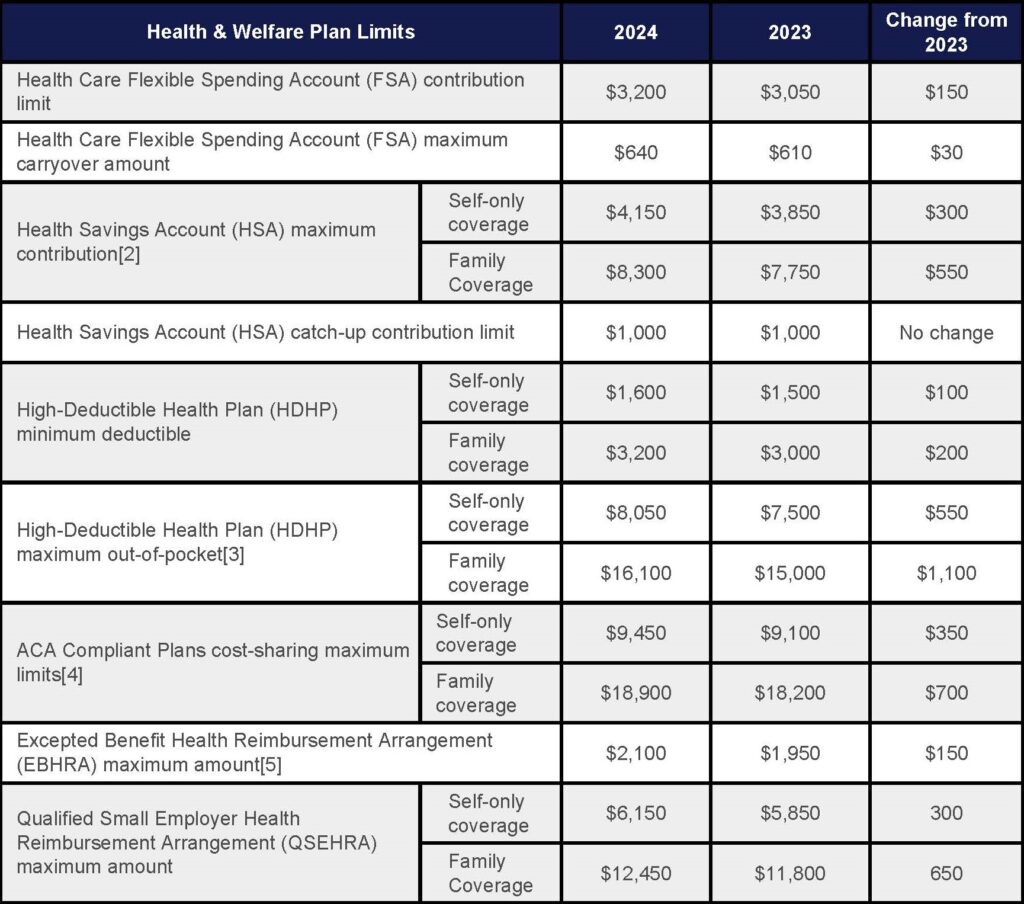

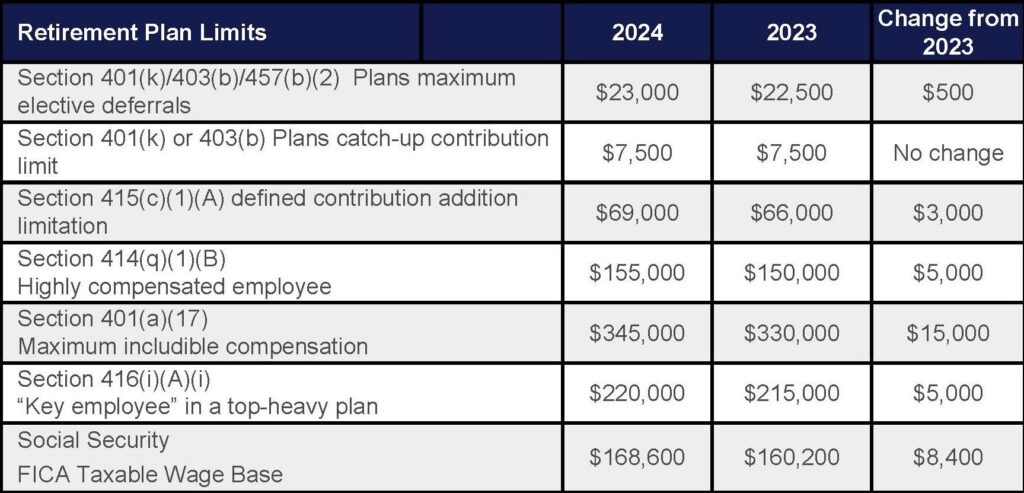

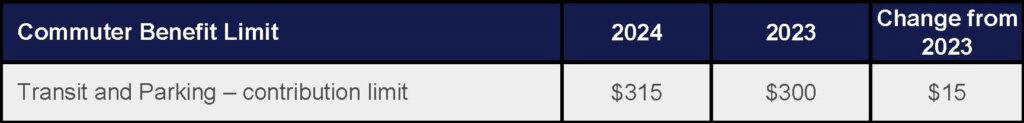

The following table is a comparison tool for employers including what you need to know about the changes in 2024 Benefit Plan Limits.

[1] Revenue Procedure 2023-23; Revenue Procedure 2023-34; IRS Notice 2023-75

[2] Includes both employee and employer contribution amount limits.

[3] Including deductibles, copayments and other amounts, but excluding premiums.

[4] The Affordable Care Act (ACA) requires health plans to place annual limits on participants’ cost sharing for essential health benefits (EHBs).

[5] Employers offer EBHRAs to reimburse the cost of excepted benefits (such as limited-scope dental or vision coverage) as well as short-term, limited-duration insurance plan premiums.

[6] For 2024, the amount excludable from an employee’s gross income begins to phase out under IRC Section 137(b)(2)(A) for taxpayers with modified adjusted gross income of more than $252,150 and is completely phased out for taxpayers with modified adjusted gross income of $292,150 or more.